Casino Loyalty Technology

An Urgent Need to Make Significant Upgrades

Introduction

The lack of innovation in casino loyalty solutions is the single largest cause of the decline and aging of the casino gaming player base. The technology behind casino loyalty is stuck in the 1990s and geared to a time before TITO became prevalent across the slot floor. As most other industries have deployed modern technology to deliver personalized, data-driven customer experiences, casino loyalty technology has not evolved beyond the outdated tier-driven direct mail model. Casino loyalty technology has also fallen significantly behind slot machine technology, as game developers have consistently advanced their offerings over the last 20 years to address changing player behaviors and preferences – including through the addition of new pay lines, bonusing concepts, more immersive screens, and modern graphics and audio packages – and suppliers consistently introduce new and popular themes to drive play and engagement.

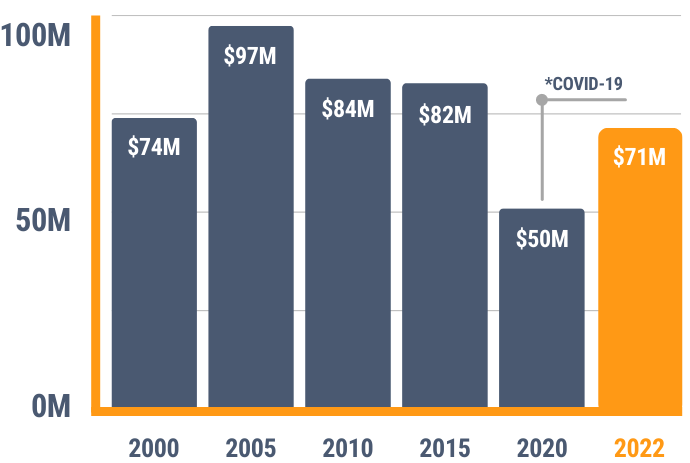

SLOT REVENUE PER CASINO

BY YEAR, ADJUSTED FOR INFLATION

Source: AGA and NIGC official data.

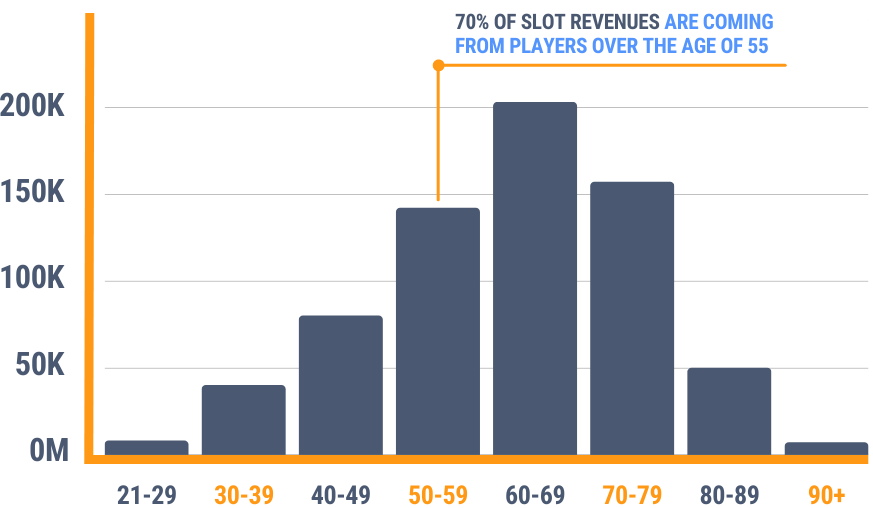

SLOT COIN-IN

BY AGE GROUP

Source: Global Gaming Business (GGB)

The inability to adapt and modernize casino loyalty solutions to address changing consumer preferences has led to an overall decline in slot revenue, which is lower now than 15 years ago despite many new jurisdictions and casinos coming online.

A substantial portion – approximately 30% – of today’s slot revenue is from players aged 70 or older. With an average U.S. life expectancy of 77 years, the casino industry must act now to lower its dependence on older players. While the implementation of cashless gaming and the development of new non-gaming amenities at casino properties have demonstrated their ability to help attract and engage younger guests, more needs to be done to enhance this engagement. The solution – the primary solution, in fact – lies in the ability of casinos to implement modern casino loyalty technology that replaces the vastly outdated solutions that underly today’s gaming floors.

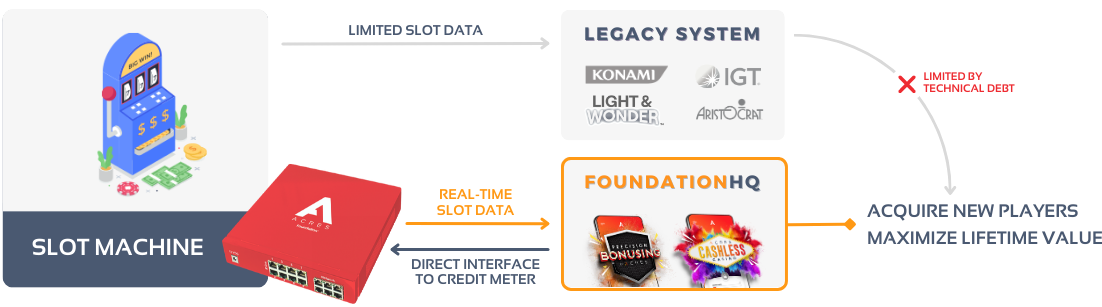

SYSTEMS WERE PURCHASED, NOT DEVELOPED, AND INNOVATION HAS SUFFERED

The largest CMS (casino management system) providers – Aristocrat, IGT, Light & Wonder, and Konami – entered the systems business via acquisitions in the early 2000s. Aristocrat purchased Casino Data Systems and its OASIS slot system in 2001. Alliance Gaming, a predecessor to Bally Technologies (and a predecessor to both Scientific Games and today’s Light & Wonder), acquired Advanced Casino Systems Corporation in 2001. Konami acquired Paradigm Gaming Systems in 2001. And IGT acquired Acres Gaming’s Advantage casino management system in 2003.

Each of these systems carries an enormous amount of technical debt that prevents casinos from acquiring new players and maximizing the lifetime value of customers.

Why?

Because the acquired technologies were developed in the 1990s and upon their integration into the much larger suppliers, the development engineers and their expertise fell by the wayside as innovation was de-prioritized and generating cash from the existing and installed systems solutions was prioritized. Today, these technologies still very closely resemble what they were in the early 2000s, even as they combine to account for nearly 100% of CMS installs in the United States.

ACRES SETTING THE FOUNDATION® FOR THE CMS OF THE FUTURE

The casino gaming industry’s current technology gap has allowed Acres to exploit the deficiencies of legacy CMS solutions and bring new innovations to the industry, which will power the casino floor of the future.

In the coming series of articles, Acres will explore the deficiencies of the current CMS environment and discuss how its Foundation HQ™ system is capable today of changing the game for operators by offering a modern, technologically advanced CMS capable of personalizing gaming experiences to maximize the entertainment and loyalty of each customer. Foundation HQ™ is a first-of-its-kind CMS that leverages Acres’ Foundation® technology, providing casinos with real-time data from slot machines and a direct interface to the credit meter. Importantly, Foundation® provides casinos with over 1000x more data, giving operators dramatic new capabilities to analyze and influence player behavior.

Stay tuned as Acres provides the foundation for real technological change at the heart of the casino gaming industry. In addition to the above introduction, which lays out the challenges of today’s CMS solutions and the opportunity that exists for modernization, this series will cover:

This first installment of Acres’ article series explores the deficiencies of the current CMS hardware and architecture environment and how they combine to deliver a significant technological gap that is driving an overall decline in slot revenue, limiting casino operators in their efforts to cater to existing customers and to engage with new and potential customers.

HOW LEGACY SLOT SYSTEMS WORK

The core issue with existing CMS technology is badly outdated hardware and software designed to facilitate direct snail-mail marketing campaigns. These campaigns are reactionary in nature and only touch the player once they leave the casino and return to their homes, with costly one-size-fits-all incentives reaching the player’s mailbox days or weeks after their visit.

Because computing power was so much more limited in the 1990s and early 2000s, the legacy slot systems architected at that time – ancient times for technology – only query for slot machine data upon a “system event” that commonly marks the beginning and end of a player’s gaming session. Importantly, the many version updates for these systems that have taken place over the last 20 years have not and cannot address this basic shortcoming, as the root of the problem lies in the 1990s hardware that interfaces with the slot machine.

Slot machines report data in meters – think of your car’s odometer – and the slot system will request a meter report from the slot machine upon each system event, most commonly buy-in (currency or ticket insertion) and cash-out (ticket print). The player begins a session by inserting cash or a ticket, causing the legacy slot system to produce a snapshot report of the game meters. Except for rare occurrences such as a high-value jackpot, no additional player-related system event is tracked by legacy CMS solutions until the player cashes out by printing a ticket. The legacy slot system then produces a session summary by comparing the session’s starting and ending meter levels. This data is attributable to an individual player only if a player card was inserted during the play session. In addition to only being capable of processing data at distant intervals, legacy CMS hardware is only able to query the game for no more than 20% of the available meters, providing operators with an extremely limited view of their players.

One notable shortcoming of legacy systems is their inability to detect the end of a play session when no cash-out occurs. If an uncarded player inserts $20 and plays until the credit meter reaches $0, the legacy system has no way of knowing the session ended. While it will detect the next $20 inserted into the game, the legacy system simply cannot determine whether the customer is the original uncarded player or a new uncarded player. As a result, casinos are almost completely unable to identify and approach high-value uncarded players.

FOUNDATION® UPENDS SLOT FLOOR ARCHITECTURE

Foundation HQ™ is a first-of-its-kind casino management system that leverages Acres’ Foundation® hardware, which provides casinos with real-time data from slot machines and a direct interface to the credit meter on any slot machine. This allows for the collection of more than 1000x more data – all in real-time – and offers operators dramatic new capabilities to analyze and influence player behavior. Freed from the limitations of antiquated hardware, Foundation HQ™ delivers a much more intelligent and flexible operating system.

Foundation HQ™ operates by interfacing with Acres’ Foundation® hardware installed in each slot machine on the casino floor, which connects directly to the data port and can operate either as a new, standalone CMS or during a transition period alongside the legacy CMS hardware that remains installed and operational.

Foundation’s data collection capabilities are unmatched, allowing operators to record information on each game play, the start/end/pause time, total wager/win, and more. Further, it can enable an adaptable credit meter where bonuses are triggered by any event, including real-time game results.

Importantly, Foundation® is unique in that its architecture will allow casino operators to decide when to cut the cord on their current CMS solution. It can run alongside the current CMS and allow operators to roll out functionality on a timeline that meets their operational needs, facilitating a gradual transition to Foundation HQ™ and away from the legacy CMS as the operator experiences the features and functions within the new environment.

Over the past 20 years, companies like Meta, Amazon, and Google have achieved massive revenue growth by implementing technology that delivers personalized experiences by applying advanced analytics to vast amounts of data. Thanks to Foundation HQ’s modernized system architecture, Acres will enable casinos to finally harness data to achieve their significant revenue growth potential.

THE $4.94 BILLION OPPORTUNITY FROM MODERNIZING CASINO LOYALTY TECHNOLOGY

The key challenge facing the land-based casino gaming industry today is the dramatic aging of its customer base, caused by the continued reliance on 25-year-old loyalty technology provided by legacy CMS vendors such as Aristocrat, IGT, Konami, and Light & Wonder. Processes that were cutting edge in the 1990s are now badly outdated and incompatible with today’s consumer expectations, leading to an overall decline in nationwide slot revenue when adjusted for inflation.

Today’s casino loyalty and marketing revolves around the player card – a physical loyalty card the player must use to have their play tracked and rewarded. Physical loyalty cards have become extinct in nearly every other industry, leaving casinos and their customers as the very last users of an obsolete technology.

This installment of Acres’ Casino Loyalty Technology whitepaper series explores how supporting the player card costs the U.S. casino industry $4.9 billion annually – roughly 7% of industry slot win – and repels new players from joining the loyalty funnel, in turn choking off the supply of new players and ensuring the continued decline of slot profits.

COST OF THE PLAYERS CLUB

The customer’s loyalty process begins at the casino’s players club desk or office. To enroll, a prospective member must walk to the players club desk, wait in line, and then work with a casino employee to complete the enrollment process. This is a time-consuming and burdensome process incompatible with the preferences of modern consumers who, as a result, are likely to avoid the players club enrollment process and thus never become loyal players.

Casinos often dedicate high-value floor space to the players club desk, which could otherwise be used for gaming devices. In addition, they incur the labor cost of the players club. At an average of two hourly employees per shift and one salaried manager, the net annual cost of operating industry player clubs across the U.S. is over half a billion dollars.

Annual Expense, 2 CSRs per hour

Annual Expense, 1 Manager

+ $105,000

COST OF PLAYER TIME

Modern consumers want friction-free experiences, and most non-casino industries provide them with a world of ever-increasing convenience. Customers can order groceries, watch movies, and make major financial purchases of cars, real estate, or stocks from the convenience of their phones.

Land-based casinos require players to be physically present to generate revenue. Since time is a finite resource, the cost of waiting in line and not spending money is a significant yet often-overlooked casino industry expense. The cost of one minute of a player’s time is easy to calculate:

$2

On average, it takes a player ten minutes to walk to the players club, go through the enrollment process, walk to the game of their choice, and begin playing. This leads to a $16 revenue loss from each player that enrolls, with additional unquantifiable losses in patience and satisfaction.

The burdensome enrollment process doesn’t only impact new members, as existing members frequently get a new physical card printed on each visit. Twenty-five years ago, customers greatly valued the novelty of seeing their name featured on a brand’s loyalty card and would keep the card in their wallet alongside photos of loved ones. Today, few people carry wallets, photos, or physical loyalty cards, leading to an extraordinary amount of wasted time and money. More than 80% of the 110 million new cards printed annually by the industry are reprinted cards for an existing member. These players must also go through the time-consuming process of visiting the players club desk to seek a reprint of a discarded or lost player card.

In total, the casino industry makes its customers spend an astounding 1.1 billion minutes waiting in line for a player card annually, resulting in revenue losses exceeding $1.75 billion each year.

110,000,000

$1.76 Billion

PLAYER ACQUISITION COSTS

Casinos pay dearly for new player acquisition, and these expenses are ever-increasing, in part to overcome the burdensome signup process.

The most common enrollment promotion offers $10 of free play to any new signup, with absolutely no regard for the new enrollee’s actual spend history or profit potential. Legacy CMS offerings provide few marketing levers to pull other than free play, which has led to dramatic, industry-wide abuse and waste of free play and the continued erosion of slot profitability.

The expense of free play can be quantified by combining the cost of the free play and the time it takes the player to spend it. Assuming a $2 wager at 8% hold and a ten-game-per-minute pace of play, an average player requires 6.25 minutes to play off $10 in free play. Using the $1.60 per minute assumption of player value, a $10 free play promotion, therefore, costs the casino $20 to issue before the casino has earned even a cent from the new member in question.

Legacy system providers such as Aristocrat, IGT, Konami, and Light & Wonder reason that costs incurred by their player acquisition programs are smart investments because the total expense on acquisition promotion is typically 20% to 30% of revenues generated by new players in their first session. However, to offer static rewards to each new signup is to believe that all players should be valued equally, regardless of spend. If the average new play session is worth $100, this average is weighted on either side by patrons who spent much more than $100 and others who spent significantly less and possibly nothing at all. Casinos waste hundreds of millions of dollars annually in offering these players the same incentive regardless of their respective spend level.

While modern technology allows businesses to dynamically price their goods to maximize efficiency, the state of casino loyalty presents a dramatically different story. Imagine a beer priced the same in grocery stores and NFL games, Google ads costing the same regardless of keyword, or Las Vegas hotel rooms having the same rate on Dec 31 as July 31!

$10

New Members (Annual, U.S.)

22,000,000

$440,000,000

HOW FOUNDATION HQ REDUCES COSTS WHILE EXPONENTIALLY GROWING SIGNUPS

Acres’ Foundation HQ allows casinos to save 100% of the previously described player acquisition costs – $2.1 billion annually – simply by utilizing modern technology to eliminate friction from the enrollment process. In addition, Foundation HQ dramatically increases player signups by making the process so simple any player can register an account within about ten seconds from any location, including during an uncarded gaming session.

If the goal is to maximize new enrollments, the first step towards that goal is to have a system that makes player acquisition so simple that nearly everyone signs up. Legacy CMS solutions require a physical destination, human assistance, and a physical player card. They also rely on an inflexible database that requires too many fields of customer data to create an account and uses an arbitrary account identifier – the Player ID – that a typical player will never remember. This process is anything but simple.

To understand how Foundation HQ’s acquisition process works, picture the legacy CMS player database as a spreadsheet with five columns of player information: First and Last Name, Street Address, Zip Code, and Birth Date.

In this example, the legacy CMS applies rigid rules that require at least three of these columns to be completed to create an account. A sixth column, the Player ID, is added only upon creation of the account, and that Player ID becomes associated with the unique magnetic stripe on the player card given to the player. Importantly, play can only be associated with an individual after the Player ID has been created and only when the card is used, leaving casinos completely blind to all uncarded play.

FOUNDATION HQ IDENTIFIES ALL PLAY, INCLUDING UNCARDED PLAY

Foundation HQ’s first and most important advantage comes from its ability to identify and track all uncarded play. Continuing with the spreadsheet analogy, the first column – a unique Player ID – is created whenever a play session begins, regardless of card insertion. Foundation HQ’s real-time data analysis associates all play during an uncarded session to a specific Player ID using factors such as bill or ticket insertions, rate of play, and cash-outs. Even before collecting a player’s name and contact information, Foundation HQ has identified a person and begins tracking play to quantify that person’s value.

FOUNDATION HQ PERSISTENTLY SEEKS PLAYER CONTACT INFORMATION

Foundation HQ’s next objective is to convince the player to provide more data by “claiming” the uncarded play session. Getting the player to provide their contact information can be as simple as texting a unique identifier code on the game to a casino phone number. In the ten seconds it takes to send a text, the casino can associate the previously uncarded play to a specific phone number to which marketing offers can be sent, opening a dialogue designed to gather more personal information.

This method flips the existing high-friction enrollment process on its head. Rather than intruding upon the player’s privacy by demanding photo ID and other personal information before delivering a single benefit, the casino sets a low bar to enrollment, then works to gather more information after the player sees value in the relationship.

A SMARTER WAY OF INCENTIVIZING ENROLLMENT

Some players may be resistant to giving the casino even their phone number, and the casino may decide to offer valuable incentives to get them to do so. Unlike the one-size-fits-all signup incentive provided by the legacy system, Foundation HQ’s incentives can always be proportional in value to the player’s spend level.

In the beginning moments of a play session, there may be no incentive offered for enrolling. But if the player passes a certain threshold, such as spending over $20, a Level 1 incentive offer may be deployed. If the player still hasn’t enrolled and surpasses $50 in spend, Foundation HQ may present an even more attractive Level 2 offer. Ultimately, this is the chance for the casino industry to embrace a dynamic pricing model that has already been deployed successfully across most other consumer-focused industries.

Taking it one step further, Foundation HQ can track the uncarded player’s value from machine to machine by associating the play session with a cash-out voucher — the TITO ticket. When the ticket is inserted into the next machine, evaluation of the player continues, and incentives continue to escalate until the customer acquisition is achieved.

Legacy CMS acquisition programs are wasteful because they presume each player requires the same incentive to enroll. Many players are willing to enroll with no incentive at all, making any investment in this group counterproductive. For players who do require an incentive, the incentive should be proportional to the player’s demonstrated value.

ACQUISITION COSTS AS A REVENUE SOURCE

Foundation HQ delivers new capabilities for casinos to widely scale acquisition and other promotions beyond the local casino and to allow other brands to cover the cost of these promotions through sponsorships.

In 2014, Quicken Loans offered a Billion Dollar Bracket Challenge, promising a $1 billion prize for anyone who picked the winner of every game in that year’s NCAA Tournament. The promotion was heavily advertised, received over one billion social media and PR impressions in the weeks surrounding its launch, and increased brand awareness for Quicken by 300%. The entire campaign was simply an acquisition promo for Quicken Loans’ lending services, and the contest drew 15 million entrants within a week, each of whom was required to provide Quicken with their valuable contact information.

Using Foundation HQ, casinos can allow brands to sponsor their acquisition programs. The casino receives a multitude of benefits in this scenario: increased signups thanks to eliminated friction, more exciting promotions, reduced costs per signup, and even revenue per signup shared by the casino with the sponsoring brand. As the casino industry frequently associates itself with other brands – hotels, restaurants, conventions, concerts, and other live events – it has a multitude of potential partners that can be introduced into this new acquisition model.

Integrating other brands using legacy CMS technology is impossible. Why? Because in addition to all the limitations discussed previously, it is extremely difficult to interface with legacy CMS databases due to their antiquated designs. These old databases prevent the enrollment process from simultaneously acquiring player info for both the casino and the sponsor. In fact, multi-property operators are frequently unable to share player databases across their property footprint and have invested tens of millions of dollars in expensive services such as House Advantage’s HALO solution just to merge player profiles from each property, although with very limited actionable success.

VALUING NEW ACQUISITIONS

Foundation HQ dramatically grows new enrollments by removing sign-up friction by deploying a ten-second enrollment process and enabling acquisition incentives that are less expensive to offer yet far more exciting and valuable to the player.

Data from the AGA and NIGC suggest that nearly 150 million people visited commercial and tribal casinos in 2022, producing $106 billion in total gross gaming revenues – an annual rate of $714 per visitor. But not all players are created equal.

The Pareto Principle, also referred to as the 80/20 Rule, holds that 80% of revenues come from 20% of customers. If we apply this principle to casino win and visitation statistics, carded players, who represent 80% of the revenues and 20% of the players, spend $2,850 annually, while uncarded players spend just $180 – a massive difference of almost $2,700 per person. Simply put, loyal players are over 10x more profitable than transient players, and to grow revenues now and in the future, the industry must discover new and effective methods of enrolling these anonymous players.

Foundation HQ will deliver over $2.1 billion in new annual revenues by engaging half of the anonymous players in loyalty programs and increasing their annual incremental spend by 20%, or $35 each. This new spend is highly attainable because this player segment has never received any marketing offers or incentives, and the $2.1 billion of incremental spend will increase each year as newly loyal players return to the casino year after year during the customer lifecycle.

59,360,000

NET ADDED VALUE OF MODERNIZED ACQUISITION

Putting all the pieces together, Foundation HQ’s enrollment technology offers casino operators of all sizes a massive opportunity to drive efficiency (customer acquisition cost savings) and player engagement (new revenues) by enabling a modern, consumer-focused enrollment process.

The benefits provided by Foundation HQ are enterprise-wide and driven by lower labor expenses, reduced loyalty card print processes, reduced customer acquisition promotional expenses, and untapped revenue growth from new loyalty program enrollees. Ultimately, these savings and benefits represent a roughly 7% – or $5 billion upside to current industry-wide gross slot revenue and a source of growth no other investment casino operators can make today can provide.

$1.76 Billion

$495,567,000

$2.12 Billion

$4.94 Billion

6.98%

THE $37 BILLION OPPORTUNITY TO REVITALIZE CASINO LOYALTY

Despite the significant expansion in the number of casinos across the United States over the past 25 years, the U.S. casino industry produces lower inflation-adjusted revenues from slot operations today than it did in 2000. With virtually no advancements in casino loyalty technology over the past 25 years, casino operators have become unable to adapt to the preferences of present-day consumers and cannot adequately create or maximize customer relationships.

In a previous installment of the Acres position paper series evaluating the state of Casino Management System (CMS) technology, we revealed that the industry’s reliance on physical loyalty cards deprives casino operators of nearly 7% of gross revenues or roughly $5 billion annually.

Today, we highlight an even larger opportunity: By replacing wasteful free slot play with a more modern and engaging alternative, U.S. casinos can grow their annual profits by an incremental $37.2 billion – more than doubling the profitability of their slot machine operations.

ADDRESSING THE BILLIONS ALLOCATED TO PLAYER REINVESTMENT EVERY YEAR

Over nearly three decades, casino loyalty programs have become remarkably similar. A typical program follows the same protocol: For each wager made, an enrolled player earns points that can be redeemed at the casino for gifts, free play, or cash back. Because the predominant redemption item is free play, a casino’s loyalty program is highly transactional with players and highly competitive with other casinos.

While casinos advertise their rewards clubs as fixed rate reinvestment programs, in reality, these are variable rate systems that expose casinos to lost profits (or even net losses) on existing players and lost opportunities to convert new and novice players into loyal, profitable customers.

To illustrate the profit burden imposed by legacy loyalty programs, consider Casino Operator A, a well-respected brand with a loyalty program that mirrors the industry norm. At a Casino Operator A property, players earn 1 point per $1 wagered on slots and can earn $1 of free play or cash back for every 500 points earned. Considering the average slot hold percentage of roughly 8%, Casino Operator A’s built-in reinvestment rate on its point program appears to be just 2.5%.

CASINO OPERATOR A’s POINT PROGRAM – ENTRY LEVEL TIER

$1

500

8%

$40

2.5%

$1

Points per $1 Reward (low tier)

500

VIP Slot Hold %

8%

Revenue per $1 Reward

$40

Reinvestment Rate %

2.5%

But Casino Operator A’s loyalty program exposes their operation to lost profits on higher tier players who are provided advantaged redemption rates. These losses are accelerated when the VIP tier member selects a video slot machine with a lower hold percentage and plays on a day with a regularly scheduled point or redemption multiplier.

CASINO OPERATOR A’s POINT PROGRAM – VIP TIER

VIP Slot Hold %

Reinvestment Rate %

$1

400

5%

15x

$1.33

75%

$1

Points per $1 Reward (low tier)

400

VIP Slot Hold %

5%

Max Multiplier

15x

Revenue per $1 Reward

$1.33

Reinvestment Rate %

75%

Our survey of nearly 200 U.S. casinos found that many loyalty programs provide players reinvestment rates approaching or exceeding 100% when exploited optimally and only maintain profitability through breakage caused by unredeemed rewards or players that do not take full advantage of the program. While players do have to “earn up” to the most advantaged loyalty tier, nearly every casino offers tier matching that provides players advancement to a tier corresponding with their status at a competing casino. This structure makes it possible for value-driven players – known in the industry as advantage players – to access VIP status at almost every casino in the country after earning it at a single property.

The casino point redemption program isn’t the only source of free play. Casino marketing programs issue free play to new members just for signing up, offer regular free play allowances to existing members, and establish busy promotional calendars with special events such as tournaments and drawings that offer hundreds of thousands of dollars of free play and other prizes each month. Importantly, most of these events don’t even require that a player redeem points to participate.

All told, the industry’s reported net reinvestment on slot machine revenues conservatively hovers above 35%, with free play representing nearly 50% of the total expense.

REPORTED CASINO REINVESTMENT

Free Play Reinvestment

Other Hard Cost Reinvestment

Reinvestment %

$24.8 billion

35%

Gross Slot Win

$71 billion

Free Play Reinvestment

$12.4 billion

Other Hard Cost Reinvestment

$12.4 billion

Net Reinvestment

$24.8 billion

Reinvestment %

35%

A closer examination reveals that free play is actually much more expensive than reported, ballooning net reinvestments to well above 50% of slot revenues.

THE TRUE COST OF FREE PLAY

Casino operators have debated the true cost of free play for years, with many asserting that the cost of free play is significantly less than a cash dollar. But with so many loyalty programs offering free play and cash back at the same exchange rate, it can no longer be debated that $1 of free play carries at least the same cost to the casino as $1 of cash.

The truth is that $1 of free play is significantly more expensive than $1 in cash because it occupies the limited time a player has available to spend their own money.

Consider the impact of free play on Novice Player 1, who has a gaming budget of $100 and one hour of available time to play. Assuming this player makes a $2 bet at an 8% hold and plays ten games per minute, each player minute produces $1.60 of win. Therefore, the casino can only expect to yield $96 of Novice Player 1’s $100 budget over one hour of play.

REVENUE YIELD – NOVICE PLAYER 1

$1.60

$96

96%

*Assumes $2 wager, 8% hold and 10 games per minute

**Novice Player 1 is constrained to $100 and one hour

Revenue per Minute*

$1.60

Revenue per Hour

$96

% of Potential Revenue Earned**

96%

*Assumes $2 wager, 8% hold and 10 games per minute

**Novice Player 1 is constrained to $100 and one hour

Understanding the player’s time constraint is key to calculating the true cost of the free play offer. While gifting $10 free play negates $10 of cash revenue the casino would have earned, it also negates any revenues the casino would have earned during the time spent using the free play.

TIME OCCUPANCY OF $10 FREE PLAY

Revenue per Game

*Assumes $2 wager, 8% hold and 10 games per minute

Revenue per Game

$0.16

Breakeven, # of Games

62.5

Breakeven, # of Minutes

6.25 minutes

*Assumes $2 wager, 8% hold and 10 games per minute

Multiplying the $1.60 per minute revenue to 6.25 minutes shows an additional $10 revenue yield lost to Novice Player 1’s free play offer, revealing that the cost of a $10 free play offer negates $20 of casino revenues. Therefore, each $1 of free play offered, in fact, costs the casino $2.

NET VALUE OF FREE PLAY

$10

$10

$20

$2

*Assumes $1.60 revenue per minute

Revenue per Game

$96

Time Value of 6.25 Minutes*

$10

Net Value of $10 Free Play

6.25 minutes

Net Value of $1 Free Play

$2

*Assumes $1.60 revenue per minute

If Novice Player 1 is given a standard $10 free play incentive, the casino’s already suboptimal yield on this player is considerably deteriorated.

IMPACT OF $10 FREE PLAYER ON NOVICE PLAYER 1’s YIELD

Revenue per Game

$96

Net Value of $10 Free Play

$20

Net Value of $10 Free Play

$20

Available Budget

$100

Net Yield %

76%

If the base slot machine is not enough to realize Novice Player 1’s full profit potential, any free play provided is severely detrimental to the casino. Yet this exact scenario occurs tens of thousands of times daily at casinos nationwide.

TRUE IMPACT OF FREE PLAY ON INDUSTRY REINVESTMENT

Revenue per Game

$71 billion

Net Value of $10 Free Play

$20

Novice Player 1 Adjusted Revenue

$12.4 billion

Free Play Reinvestment

$12.4 billion

Free Play Time Value

$12.4 billion

Net Reinvestment

$37.2 billion

Adjusted Reinvestment %

76%

Our analysis of Novice Player 1 shows that the industry’s strategy of using free play to buy loyalty is completely misaligned with modern consumer trends. Younger consumers prefer exciting experiences condensed into shorter time periods. Yet, casinos require over an hour of player time to achieve full spend rates, and the predominant loyalty strategy only lengthens these time requirements.

A more effective solution would entice Novice Player 1 to play faster or increase their wager size to maximize the player’s full available spend. With the massive impact on the bottom line, the industry should consider: if free play could be eliminated without negatively affecting player loyalty, the profitability of slot machine operations would more than double.

LEGACY CMS TECHNOLOGY REQUIRES WASTEFUL FREE PLAY USAGE

As previously detailed in this series, legacy systems technologies offered by Aristocrat, IGT, Konami, and Light & Wonder are handicapped by their antiquated 1990s-era hardware that only captures a small amount of available play data that can’t be meaningfully acted upon and certainly not in real-time. The result is a rudimentary rewards program that can do little but provide linear points and free play.

As more casinos have opened, each using the same loyalty program to compete for the same pool of customers, casino marketing has become a race to the bottom that fails to generate new players in significant volume because virtually all of the rewards are tied up in the small population of existing players. When Casino Operator A is offering up to 75% reinvestment to core players via its points program, what’s left to offer anyone else?

FREE SLOT PLAY IS AN EXPENSIVE GIFT THAT FEELS CHEAP

Anyone who has given or received a gift knows timing and delivery are just as important as the value of the gift itself. Relative to the actual retail value of free play, the free play awarded in the casino is significantly underappreciated by players because it is issued without regard to timing or delivery.

Casino point programs treat everyone within a tier identically, incurring the same liability on each player with no regard to the player’s need or desire for free play. For example, players with the same point production will receive the same amount in free play regardless of their gaming results. Casinos should legitimately ask: if a player just won $500, would an additional $20 in free play have any impact on their loyalty?

Simply put, free play is issued so liberally that it is no longer a valued gift or prize, removing its viability as a tool to attract, engage, and retain current and new players. Any observer in a casino will note players happily celebrating even small slot machine wins by cheering, calling friends over, or taking photos of the winning screen. But nobody celebrates the issuance of free play because it is a boring and predictable entitlement documented in the casino’s official terms and conditions.

WIN POTENTIAL, NOT FREE PLAY, DRIVES LOYALTY

Casinos can grow revenues and profitability exponentially by modernizing their loyalty programs to massively scale and entertain new players rather than giving away expensive yet underappreciated free play entitlements.

The guiding principle behind the design and capabilities of Acres’ Foundation HQ CMS loyalty program is simple: Casino players want to WIN, not earn!

Casinos must only look to their slot floors to understand the types of experiences that players value, and that leads to increased spend and play frequency. Many of today’s most popular slot titles offer built-in loyalty experiences that reward players with a form of “superpowers” that temporarily increase their chance to win real money.

One example is IGT’s incredibly popular video poker game, Ultimate X Poker. In this game, wins are rewarded not only by pays but also by pay multipliers offered on the following hand. In some variants of Ultimate X, multipliers are assigned to the next several hands, with an increased multiple on each successive hand. This game mechanic provides players with excitement and anticipation – hoping for a big pay not on the next hand but rather three games later when the multiplier is at its highest. While the odds may temporarily tip in the player’s favor, it’s no free ride. Players must spend their own money to achieve an Ultimate X multiplier, and few players will leave the game when the multiplier is active.

Another example of superpowers in the slot world is Aristocrat’s Fu Dai Lian Lian, which features three colored bags atop the video reels, each representing a different superpower the player can earn when the bonus round begins. Throughout the course of a game session (not just an individual play), players collect coins to fill each of the bags, which visibly change in appearance as more and more coins pile up to indicate the bonus round is near. This game creates significant emotional investment from the player, who becomes increasingly unlikely to abandon the session as the bags fill with coins. Importantly, players must spend their own money to fully leverage this superpower-enabled bonus feature.

FOUNDATION HQ IS UNIQUELY POSITIONED TO REVITALIZE CASINO LOYALTY

Acres’ Foundation HQ replaces free play with a gamified loyalty experience delivered as players continue to spend their own money. The result is a more exciting customer experience, more newly acquired customers, and a casino industry that becomes significantly more profitable.

Where legacy CMS systems are best suited to produce one-to-many marketing offers, Foundation HQ processes granular, real-time data and can modify the individual player experience at any moment. Where Ultimate X applies a multiplier upon winning hands, Foundation HQ applies loyalty multipliers and other superpowers that target players on a one-to-one basis.

Foundation HQ doesn’t require awards to be issued linearly relative to coin-in. Instead, players can be rewarded according to their individual needs only when data suggests the receiving player will become more likely to increase their spend. These personalized loyalty bonuses are designed to provide players value across three principal budgets: the budget for time, the budget for money, and the budget for attention.

The newly available real-time data stream allows Foundation HQ to set historical and predictive benchmarks for each player related to session duration, spend, and volatility. Consider again the player with a $100, one-hour gaming budget. Rather than provide a wasteful generalized free play gift that erodes profitability, Foundation HQ works to create an outcome that delivers both the $100 in revenue to the casino and the one hour of entertainment to the player.

Foundation HQ can also play a role in minimizing problem gambling by using granular data to identify customers who begin to exhibit impulsive and unhealthy behaviors.

HOW FOUNDATION HQ MODERNIZES THE SLOT GAMING EXPERIENCE

Foundation HQ’s ability to write credits to a slot machine’s credit meter enables bonus credits to be added anytime. Bonus credit value can be determined by the individual game result to deliver a multiplier experience like Ultimate X Poker or from an external source such as a fixed value or progressive jackpot.

Acres’ Ticket-In Bonus-Out (“TIBO”) technology offers another novel means of modernizing the play experience using the ticket printer to deliver bonuses. Printed TIBO bonus tickets can be inserted for credits at any machine or redeemed for non-gaming value elsewhere, such as the casino’s website or redemption center.

The ability to provide personalized gaming experiences particularly benefits casino operators with online casino and sports betting businesses. These operators pay hundreds of dollars per customer acquisition in hopes of generating cross-platform brand loyalty. They may consider offering a prize pool or jackpot exclusive to slot players who are also online sports betting customers as an alternative, lower-cost means of incentivizing acquisitions.

Consider a loyalty bonus provided by Foundation HQ that offers a limited period to double the next pay of 200 – 500 credits. As a countdown timer winds down from three minutes, the player begins to rapidly wager in hopes of hitting a qualifying pay.

This loyalty bonus offers the casino tremendous profit potential compared to free play. The bonus is only issued to players the casino wants to target, such as players at risk of prematurely abandoning a play session. Further, while the perceived value of the bonus is high (500 credits), few players will win anything, and the qualifying pays that do occur will be distributed predominantly on the low end of the pay scale. Most importantly, the bonus generates real-money wagers that maximize player spend and entertainment value, which in turn attracts new engagement from new players.

REPLACING FREE PLAY UNLOCKS MORE THAN $37 BILLION IN NEW PROFITS

With so much being wasted on free play, Acres is calling for casino operators to search urgently for a more effective and profitable replacement. The opportunity to reshape industry profitability through loyalty is the key purpose of Foundation HQ and the subject of our patent portfolio, which now stands at 179 issued U.S. patents.

| Legacy CMS Loyalty | Foundation HQ Loyalty | Foundation HQ Impact | |

|---|---|---|---|

| Slot Win | $71 billion | $83.4 billion | $12.4 billion |

| Hard Cost Reinvestment | $12.4 billion | $12.4 billion | $0 |

| Free Play Reinvestment | $12.4 billion | $0 | $12.4 billion |

| Free Play Time Value | $12.4 billion | $0 | $12.4 billion |

| Post-Reinvestment Gross Profit | $33.8 billion | $71 billion | $37.2 billion |

| Post-Reinvestment Gross Profit % | 47.7% | 85.1% | 37.4% |

Foundation HQ is a unique, new solution that will change the ways casinos reinvest in player loyalty, ultimately leading to an entirely new economic model for casinos. Acres believes that with Foundation HQ, operators have an unmatched opportunity to ramp up and grow their businesses and position themselves for an era of accelerating profit growth.

This first installment of Acres’ article series explores the deficiencies of the current CMS hardware and architecture environment and how they combine to deliver a significant technological gap that is driving an overall decline in slot revenue, limiting casino operators in their efforts to cater to existing customers and to engage with new and potential customers.

HOW LEGACY SLOT SYSTEMS WORK

The core issue with existing CMS technology is badly outdated hardware and software designed to facilitate direct snail-mail marketing campaigns. These campaigns are reactionary in nature and only touch the player once they leave the casino and return to their homes, with costly one-size-fits-all incentives reaching the player’s mailbox days or weeks after their visit.

Because computing power was so much more limited in the 1990s and early 2000s, the legacy slot systems architected at that time – ancient times for technology – only query for slot machine data upon a “system event” that commonly marks the beginning and end of a player’s gaming session. Importantly, the many version updates for these systems that have taken place over the last 20 years have not and cannot address this basic shortcoming, as the root of the problem lies in the 1990s hardware that interfaces with the slot machine.

Slot machines report data in meters – think of your car’s odometer – and the slot system will request a meter report from the slot machine upon each system event, most commonly buy-in (currency or ticket insertion) and cash-out (ticket print). The player begins a session by inserting cash or a ticket, causing the legacy slot system to produce a snapshot report of the game meters. Except for rare occurrences such as a high-value jackpot, no additional player-related system event is tracked by legacy CMS solutions until the player cashes out by printing a ticket. The legacy slot system then produces a session summary by comparing the session’s starting and ending meter levels. This data is attributable to an individual player only if a player card was inserted during the play session. In addition to only being capable of processing data at distant intervals, legacy CMS hardware is only able to query the game for no more than 20% of the available meters, providing operators with an extremely limited view of their players.

One notable shortcoming of legacy systems is their inability to detect the end of a play session when no cash-out occurs. If an uncarded player inserts $20 and plays until the credit meter reaches $0, the legacy system has no way of knowing the session ended. While it will detect the next $20 inserted into the game, the legacy system simply cannot determine whether the customer is the original uncarded player or a new uncarded player. As a result, casinos are almost completely unable to identify and approach high-value uncarded players.

FOUNDATION® UPENDS SLOT FLOOR ARCHITECTURE

Foundation HQ™ is a first-of-its-kind casino management system that leverages Acres’ Foundation® hardware, which provides casinos with real-time data from slot machines and a direct interface to the credit meter on any slot machine. This allows for the collection of more than 1000x more data – all in real-time – and offers operators dramatic new capabilities to analyze and influence player behavior. Freed from the limitations of antiquated hardware, Foundation HQ™ delivers a much more intelligent and flexible operating system.

Foundation HQ™ operates by interfacing with Acres’ Foundation® hardware installed in each slot machine on the casino floor, which connects directly to the data port and can operate either as a new, standalone CMS or during a transition period alongside the legacy CMS hardware that remains installed and operational.

Foundation’s data collection capabilities are unmatched, allowing operators to record information on each game play, the start/end/pause time, total wager/win, and more. Further, it can enable an adaptable credit meter where bonuses are triggered by any event, including real-time game results.

Importantly, Foundation® is unique in that its architecture will allow casino operators to decide when to cut the cord on their current CMS solution. It can run alongside the current CMS and allow operators to roll out functionality on a timeline that meets their operational needs, facilitating a gradual transition to Foundation HQ™ and away from the legacy CMS as the operator experiences the features and functions within the new environment.

Over the past 20 years, companies like Meta, Amazon, and Google have achieved massive revenue growth by implementing technology that delivers personalized experiences by applying advanced analytics to vast amounts of data. Thanks to Foundation HQ’s modernized system architecture, Acres will enable casinos to finally harness data to achieve their significant revenue growth potential.

THE $4.94 BILLION OPPORTUNITY FROM MODERNIZING CASINO LOYALTY TECHNOLOGY

The key challenge facing the land-based casino gaming industry today is the dramatic aging of its customer base, caused by the continued reliance on 25-year-old loyalty technology provided by legacy CMS vendors such as Aristocrat, IGT, Konami, and Light & Wonder. Processes that were cutting edge in the 1990s are now badly outdated and incompatible with today’s consumer expectations, leading to an overall decline in nationwide slot revenue when adjusted for inflation.

Today’s casino loyalty and marketing revolves around the player card – a physical loyalty card the player must use to have their play tracked and rewarded. Physical loyalty cards have become extinct in nearly every other industry, leaving casinos and their customers as the very last users of an obsolete technology.

This installment of Acres’ Casino Loyalty Technology whitepaper series explores how supporting the player card costs the U.S. casino industry $4.9 billion annually – roughly 7% of industry slot win – and repels new players from joining the loyalty funnel, in turn choking off the supply of new players and ensuring the continued decline of slot profits.

COST OF THE PLAYERS CLUB

The customer’s loyalty process begins at the casino’s players club desk or office. To enroll, a prospective member must walk to the players club desk, wait in line, and then work with a casino employee to complete the enrollment process. This is a time-consuming and burdensome process incompatible with the preferences of modern consumers who, as a result, are likely to avoid the players club enrollment process and thus never become loyal players.

Casinos often dedicate high-value floor space to the players club desk, which could otherwise be used for gaming devices. In addition, they incur the labor cost of the players club. At an average of two hourly employees per shift and one salaried manager, the net annual cost of operating industry player clubs across the U.S. is over half a billion dollars.

Annual Expense, 2 CSRs per hour

Annual Expense, 1 Manager

+ $105,000

COST OF PLAYER TIME

Modern consumers want friction-free experiences, and most non-casino industries provide them with a world of ever-increasing convenience. Customers can order groceries, watch movies, and make major financial purchases of cars, real estate, or stocks from the convenience of their phones.

Land-based casinos require players to be physically present to generate revenue. Since time is a finite resource, the cost of waiting in line and not spending money is a significant yet often-overlooked casino industry expense. The cost of one minute of a player’s time is easy to calculate:

$2

On average, it takes a player ten minutes to walk to the players club, go through the enrollment process, walk to the game of their choice, and begin playing. This leads to a $16 revenue loss from each player that enrolls, with additional unquantifiable losses in patience and satisfaction.

The burdensome enrollment process doesn’t only impact new members, as existing members frequently get a new physical card printed on each visit. Twenty-five years ago, customers greatly valued the novelty of seeing their name featured on a brand’s loyalty card and would keep the card in their wallet alongside photos of loved ones. Today, few people carry wallets, photos, or physical loyalty cards, leading to an extraordinary amount of wasted time and money. More than 80% of the 110 million new cards printed annually by the industry are reprinted cards for an existing member. These players must also go through the time-consuming process of visiting the players club desk to seek a reprint of a discarded or lost player card.

In total, the casino industry makes its customers spend an astounding 1.1 billion minutes waiting in line for a player card annually, resulting in revenue losses exceeding $1.75 billion each year.

110,000,000

$1.76 Billion

PLAYER ACQUISITION COSTS

Casinos pay dearly for new player acquisition, and these expenses are ever-increasing, in part to overcome the burdensome signup process.

The most common enrollment promotion offers $10 of free play to any new signup, with absolutely no regard for the new enrollee’s actual spend history or profit potential. Legacy CMS offerings provide few marketing levers to pull other than free play, which has led to dramatic, industry-wide abuse and waste of free play and the continued erosion of slot profitability.

The expense of free play can be quantified by combining the cost of the free play and the time it takes the player to spend it. Assuming a $2 wager at 8% hold and a ten-game-per-minute pace of play, an average player requires 6.25 minutes to play off $10 in free play. Using the $1.60 per minute assumption of player value, a $10 free play promotion, therefore, costs the casino $20 to issue before the casino has earned even a cent from the new member in question.

Legacy system providers such as Aristocrat, IGT, Konami, and Light & Wonder reason that costs incurred by their player acquisition programs are smart investments because the total expense on acquisition promotion is typically 20% to 30% of revenues generated by new players in their first session. However, to offer static rewards to each new signup is to believe that all players should be valued equally, regardless of spend. If the average new play session is worth $100, this average is weighted on either side by patrons who spent much more than $100 and others who spent significantly less and possibly nothing at all. Casinos waste hundreds of millions of dollars annually in offering these players the same incentive regardless of their respective spend level.

While modern technology allows businesses to dynamically price their goods to maximize efficiency, the state of casino loyalty presents a dramatically different story. Imagine a beer priced the same in grocery stores and NFL games, Google ads costing the same regardless of keyword, or Las Vegas hotel rooms having the same rate on Dec 31 as July 31!

$10

New Members (Annual, U.S.)

22,000,000

$440,000,000

HOW FOUNDATION HQ REDUCES COSTS WHILE EXPONENTIALLY GROWING SIGNUPS

Acres’ Foundation HQ allows casinos to save 100% of the previously described player acquisition costs – $2.1 billion annually – simply by utilizing modern technology to eliminate friction from the enrollment process. In addition, Foundation HQ dramatically increases player signups by making the process so simple any player can register an account within about ten seconds from any location, including during an uncarded gaming session.

If the goal is to maximize new enrollments, the first step towards that goal is to have a system that makes player acquisition so simple that nearly everyone signs up. Legacy CMS solutions require a physical destination, human assistance, and a physical player card. They also rely on an inflexible database that requires too many fields of customer data to create an account and uses an arbitrary account identifier – the Player ID – that a typical player will never remember. This process is anything but simple.

To understand how Foundation HQ’s acquisition process works, picture the legacy CMS player database as a spreadsheet with five columns of player information: First and Last Name, Street Address, Zip Code, and Birth Date.

In this example, the legacy CMS applies rigid rules that require at least three of these columns to be completed to create an account. A sixth column, the Player ID, is added only upon creation of the account, and that Player ID becomes associated with the unique magnetic stripe on the player card given to the player. Importantly, play can only be associated with an individual after the Player ID has been created and only when the card is used, leaving casinos completely blind to all uncarded play.

FOUNDATION HQ IDENTIFIES ALL PLAY, INCLUDING UNCARDED PLAY

Foundation HQ’s first and most important advantage comes from its ability to identify and track all uncarded play. Continuing with the spreadsheet analogy, the first column – a unique Player ID – is created whenever a play session begins, regardless of card insertion. Foundation HQ’s real-time data analysis associates all play during an uncarded session to a specific Player ID using factors such as bill or ticket insertions, rate of play, and cash-outs. Even before collecting a player’s name and contact information, Foundation HQ has identified a person and begins tracking play to quantify that person’s value.

FOUNDATION HQ PERSISTENTLY SEEKS PLAYER CONTACT INFORMATION

Foundation HQ’s next objective is to convince the player to provide more data by “claiming” the uncarded play session. Getting the player to provide their contact information can be as simple as texting a unique identifier code on the game to a casino phone number. In the ten seconds it takes to send a text, the casino can associate the previously uncarded play to a specific phone number to which marketing offers can be sent, opening a dialogue designed to gather more personal information.

This method flips the existing high-friction enrollment process on its head. Rather than intruding upon the player’s privacy by demanding photo ID and other personal information before delivering a single benefit, the casino sets a low bar to enrollment, then works to gather more information after the player sees value in the relationship.

A SMARTER WAY OF INCENTIVIZING ENROLLMENT

Some players may be resistant to giving the casino even their phone number, and the casino may decide to offer valuable incentives to get them to do so. Unlike the one-size-fits-all signup incentive provided by the legacy system, Foundation HQ’s incentives can always be proportional in value to the player’s spend level.

In the beginning moments of a play session, there may be no incentive offered for enrolling. But if the player passes a certain threshold, such as spending over $20, a Level 1 incentive offer may be deployed. If the player still hasn’t enrolled and surpasses $50 in spend, Foundation HQ may present an even more attractive Level 2 offer. Ultimately, this is the chance for the casino industry to embrace a dynamic pricing model that has already been deployed successfully across most other consumer-focused industries.

Taking it one step further, Foundation HQ can track the uncarded player’s value from machine to machine by associating the play session with a cash-out voucher — the TITO ticket. When the ticket is inserted into the next machine, evaluation of the player continues, and incentives continue to escalate until the customer acquisition is achieved.

Legacy CMS acquisition programs are wasteful because they presume each player requires the same incentive to enroll. Many players are willing to enroll with no incentive at all, making any investment in this group counterproductive. For players who do require an incentive, the incentive should be proportional to the player’s demonstrated value.

ACQUISITION COSTS AS A REVENUE SOURCE

Foundation HQ delivers new capabilities for casinos to widely scale acquisition and other promotions beyond the local casino and to allow other brands to cover the cost of these promotions through sponsorships.

In 2014, Quicken Loans offered a Billion Dollar Bracket Challenge, promising a $1 billion prize for anyone who picked the winner of every game in that year’s NCAA Tournament. The promotion was heavily advertised, received over one billion social media and PR impressions in the weeks surrounding its launch, and increased brand awareness for Quicken by 300%. The entire campaign was simply an acquisition promo for Quicken Loans’ lending services, and the contest drew 15 million entrants within a week, each of whom was required to provide Quicken with their valuable contact information.

Using Foundation HQ, casinos can allow brands to sponsor their acquisition programs. The casino receives a multitude of benefits in this scenario: increased signups thanks to eliminated friction, more exciting promotions, reduced costs per signup, and even revenue per signup shared by the casino with the sponsoring brand. As the casino industry frequently associates itself with other brands – hotels, restaurants, conventions, concerts, and other live events – it has a multitude of potential partners that can be introduced into this new acquisition model.

Integrating other brands using legacy CMS technology is impossible. Why? Because in addition to all the limitations discussed previously, it is extremely difficult to interface with legacy CMS databases due to their antiquated designs. These old databases prevent the enrollment process from simultaneously acquiring player info for both the casino and the sponsor. In fact, multi-property operators are frequently unable to share player databases across their property footprint and have invested tens of millions of dollars in expensive services such as House Advantage’s HALO solution just to merge player profiles from each property, although with very limited actionable success.

VALUING NEW ACQUISITIONS

Foundation HQ dramatically grows new enrollments by removing sign-up friction by deploying a ten-second enrollment process and enabling acquisition incentives that are less expensive to offer yet far more exciting and valuable to the player.

Data from the AGA and NIGC suggest that nearly 150 million people visited commercial and tribal casinos in 2022, producing $106 billion in total gross gaming revenues – an annual rate of $714 per visitor. But not all players are created equal.

The Pareto Principle, also referred to as the 80/20 Rule, holds that 80% of revenues come from 20% of customers. If we apply this principle to casino win and visitation statistics, carded players, who represent 80% of the revenues and 20% of the players, spend $2,850 annually, while uncarded players spend just $180 – a massive difference of almost $2,700 per person. Simply put, loyal players are over 10x more profitable than transient players, and to grow revenues now and in the future, the industry must discover new and effective methods of enrolling these anonymous players.

Foundation HQ will deliver over $2.1 billion in new annual revenues by engaging half of the anonymous players in loyalty programs and increasing their annual incremental spend by 20%, or $35 each. This new spend is highly attainable because this player segment has never received any marketing offers or incentives, and the $2.1 billion of incremental spend will increase each year as newly loyal players return to the casino year after year during the customer lifecycle.

59,360,000

NET ADDED VALUE OF MODERNIZED ACQUISITION

Putting all the pieces together, Foundation HQ’s enrollment technology offers casino operators of all sizes a massive opportunity to drive efficiency (customer acquisition cost savings) and player engagement (new revenues) by enabling a modern, consumer-focused enrollment process.

The benefits provided by Foundation HQ are enterprise-wide and driven by lower labor expenses, reduced loyalty card print processes, reduced customer acquisition promotional expenses, and untapped revenue growth from new loyalty program enrollees. Ultimately, these savings and benefits represent a roughly 7% – or $5 billion upside to current industry-wide gross slot revenue and a source of growth no other investment casino operators can make today can provide.

$1.76 Billion

$495,567,000

$2.12 Billion

$4.94 Billion

6.98%

*Article Coming Soon