Acres’ Foundation technology has made possible the introduction of a new casino industry metric – Player Budget – that clearly identifies each player’s specific gambling budget. Player Budget sets a benchmark for a player’s largest in-session loss, thereby indicating the spend limit of each individual player. Knowing each customer’s Player Budget will enable casino operators to dramatically improve their direct marketing strategies by prioritizing players with deeper pockets and higher profit potential.

Today’s casino marketing efforts are hamstrung by the generations old hardware offered by legacy systems vendors such as Aristocrat, IGT, Konami and Light & Wonder, which primarily value players using erroneous “Theoretical Loss” or “Actual Loss” metrics. With casinos spending nearly $25 billion per year on player incentives, the industry stands to benefit significantly from enhanced, data-driven marketing techniques that have been deployed with great success in other industries.

The predominant method casinos use to rate player value is known as Theoretical Win. Casinos use Theoretical Win to create marketing offers designed to incentivize player visits.

The table below demonstrates how a casino calculates its Theoretical Win from each player.

Once Theoretical Win is set, players are generally split into tiers, with players in each tier receiving roughly the same offer value. Theoretical Win is also used in special events marketing. For example, a casino offering a two-night hotel and party package for Super Bowl weekend will use each player’s Theoretical Win to qualify them for the event.

At times, casinos may use “Actual Win” in addition to or in lieu of Theoretical Win, such as when a high limit player loses a large amount over too small a sample of games to produce a significant “Theoretical” value.

The specific challenge casinos face is that both Theoretical Win and Actual Win are non-predictive, easily manipulated by players and highly inaccurate.

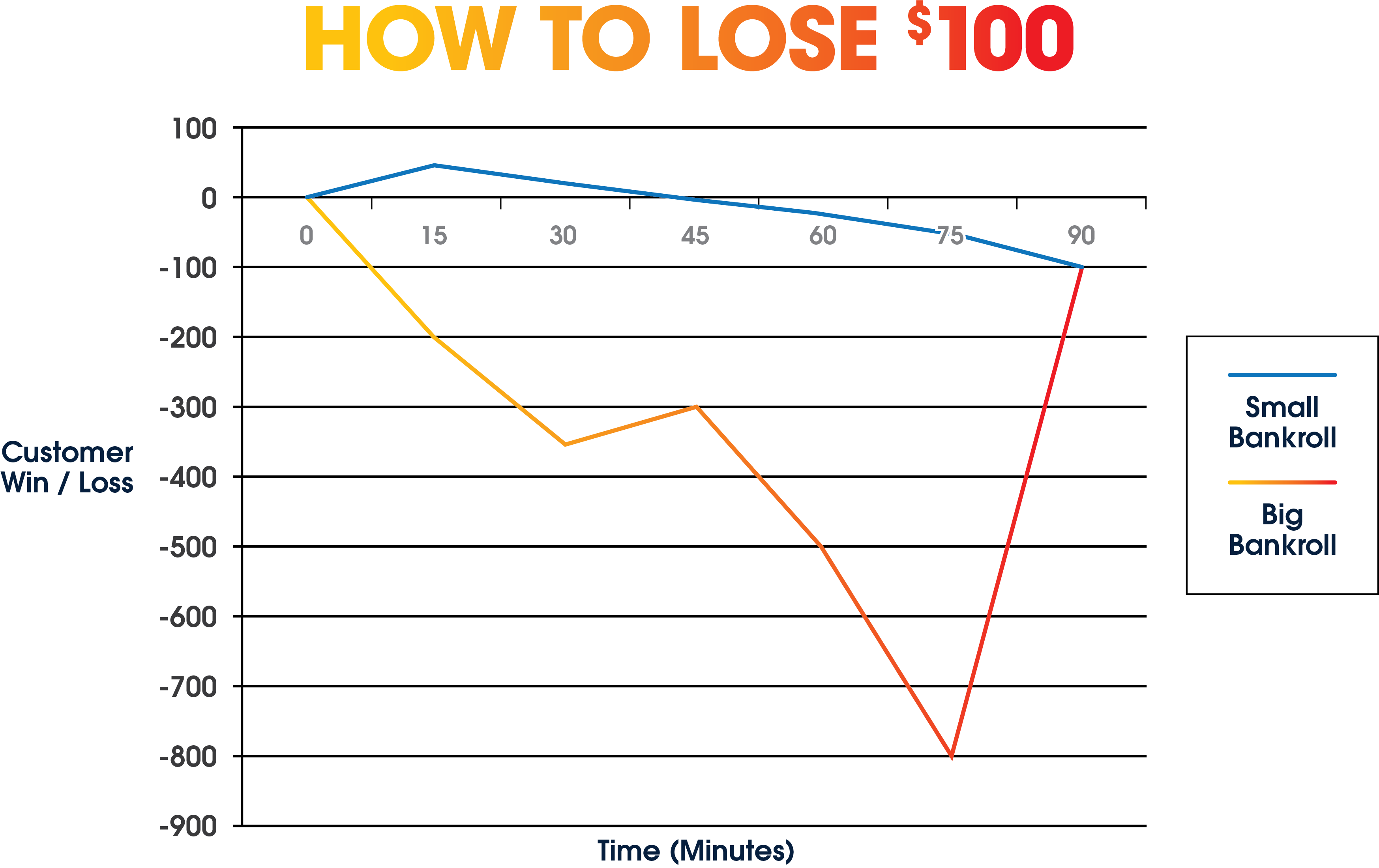

Acres’ new Player Budget feature illuminates the true value of these players. Player B has a demonstrated ability to spend eight times more than Player A, and the casino marketing team should therefore prioritize return visits from Player B over Player A. In addition, the casino knows that Player B has $700 in-hand, right now, which will become invaluable information as the casino begins to adopt more technology that enables them to issue real-time marketing incentives to players who are still at the casino.

Loyalty marketing can become counter effective if costly rewards are redeemed by customers who would have purchased even without the reward, or if the incremental revenue produced is not justified by the cost of the reward issued. While the broader promotion may be a success, a reduction in wasted marketing funds represents new profits for the casino.

Casinos have great difficulty refining marketing offers to maximize profit because their entire system is built on rewards (which are entitlements) for past play rather than incentives for new play. Players know that rewards are determined by coin-in and a quick Google search shows a host of websites, books and videos instructing players on how to maximize rewards while minimizing spend.

Consider a common trick that players have used to inflate their Theoretical and Actual losses and maximize their rewards. As a machine enters a bonus round, crafty players remove their player card to obfuscate their true value. Many legacy casino management systems operating today are unable to attribute the bonus payouts to the carded member, resulting in the player’s Actual Win becoming greatly exaggerated. Next, the player uses the bonus pay to rack up “free Theoretical,” further misleading the casino about their actual value. Finally, the player uses their exaggerated loss to produce a favorable “Win/Loss” report at the end of the year, thereby evading tax liability on any jackpots won over the year.

Unlike Theoretical Win or Actual Win, Player Budget defines the player’s true ability and willingness to spend in a way that cannot be masked.

Casinos using Foundation can utilize Player Budget to develop a comprehensive strategy for each player – carded and uncarded – to maximize spend and loyalty.

By combining Player Budget with other data points such as visit frequency, session duration and tolerance for volatility, Foundation recommends one of four actions to maximize the value of each player relationship.

Casino personnel and in-game outreach to encourage enrollment

The chart below demonstrates this analysis in action, resulting in an optimal marketing course being charted for each player.

Using the faulty Theoretical Win measurement, the casino’s rewards-based system will greatly favor Player C, resulting in a marketing strategy that is directly opposite of what the casino should actually do to maximize revenues.

While the casino’s relationship to Player C is extremely important and profitable, Player C’s loyalty is already maximized and the casino should simply seek to maintain this relationship.

Earning additional trips from Player D is where the true profit potential is. In just two visits, Player D has demonstrated an ability to spend over 3.5 times more per visit than Player C. Because of Player D’s deep pockets and sparse visit history, the casino stands to gain significantly by any incremental trips and should work to maximize the relationship by increasing efforts over and above what the legacy system recommends. The casino may even conclude Player D is an active slot player who is loyal to a competing casino and can leverage this data to flip the player’s loyalty and gain market share from a competitor.

Casino operators using legacy systems technologies are provided few tools to combat problem gambling.

The key tool in the casino’s tool kit is a self-exclusion list where the player themselves must opt out of marketing offers. However, this method is becoming increasingly insufficient in preventing problem gambling. Casinos worldwide are now finding themselves subject to player lawsuits, government fines and tighter regulations that threaten continued profitability. Regulators and anti-gambling interests in Australia, for example, are using the guise of problem gaming protections to impose player spend and time limits on all players – not just compulsive gamblers.

The Player Budget feature can play an important role in preventing problem gambling by identifying compulsive behavior in real-time, allowing casinos to intervene and ensure the player is not spending more than they realize.

As a player’s visits increase, the Player Budget metric becomes more and more accurate in determining the player’s spend limits. Therefore, a player suddenly spending significantly more during a visit could prompt a welfare check by a casino representative in real-time.

Player Budget can also be vital in a casino’s anti-money laundering (AML) efforts. Casinos face unprecedented scrutiny over how they identify and prevent fraud and money laundering. In recent years, multiple casinos have been fined tens or hundreds of millions of dollars by regulators for not complying with increasingly complex AML laws. Casinos would benefit greatly by being notified of suspicious activity in real-time, such as when a large series of bill insertions takes place without correlating play.

The inability to adapt and modernize casino loyalty solutions to address changing consumer preferences has led to an overall decline in slot revenue, which is lower now than 15 years ago despite many new jurisdictions and casinos coming online.

As most other industries have deployed modern technology to deliver personalized, data-driven customer experiences, casino loyalty technology has not evolved beyond the outdated tier-driven direct mail model which is driven almost entirely by unreliable metrics like Theoretical Win.

By deploying Acres’ Player Budget tool, casinos can accurately quantify player spend habits in a way that can’t be faked or blurred, resulting in a new ability to optimize their $25 billion in annual marketing expenses.

8400 W Sunset Rd • Suite 230

Las Vegas, NV 89113

© Copyright – Acres Manufacturing Company